RBI Repo Rate 2025 – Impact on Home Loans, MSMEs & Investors

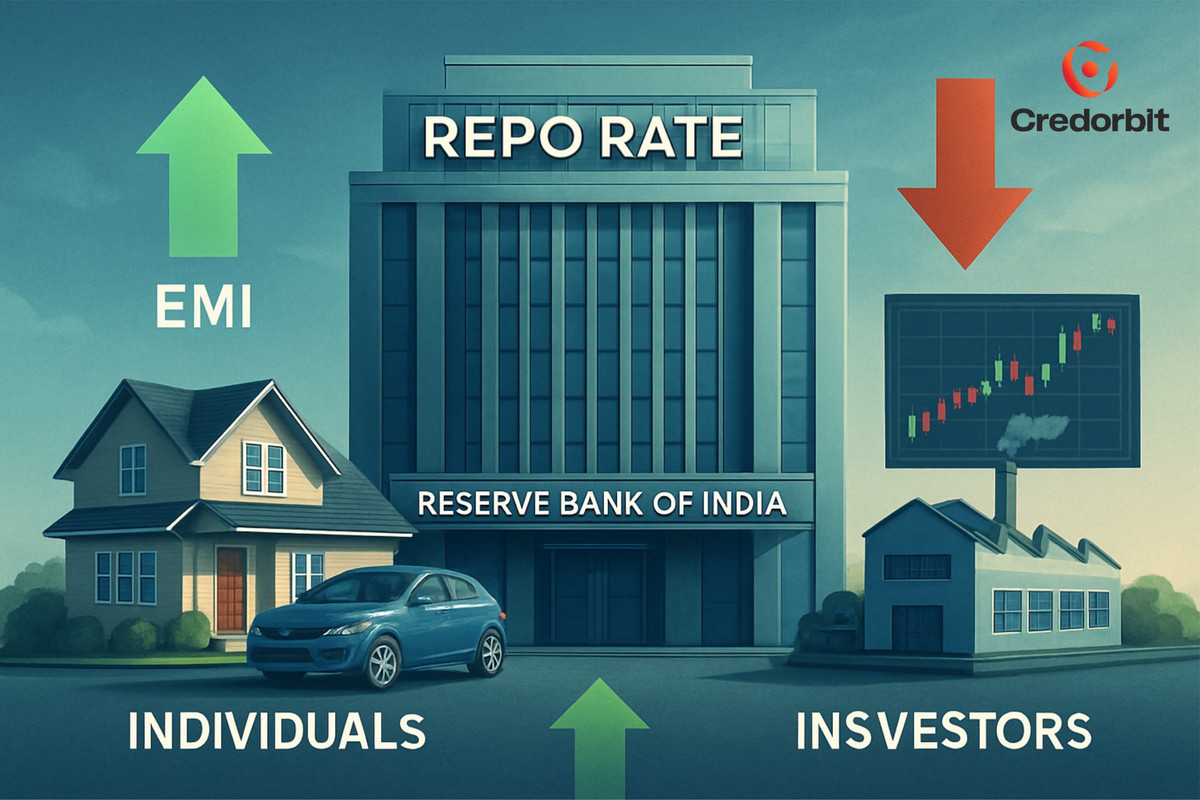

Every few months, the Reserve Bank of India (RBI) announces changes to the repo rate. While it may sound technical, it directly impacts your EMIs, business loans, and even investments. In 2025, as India balances inflation control and economic growth, repo rate decisions become crucial for homeowners, startups, and investors alike.

What is the Repo Rate?

The repo rate (repurchase rate) is the interest rate at which RBI lends money to commercial banks in exchange for government securities.

- When repo rate goes up → loans costlier

- When repo rate goes down → loans cheaper

- Tool to manage inflation and liquidity

- Affects home loans, EMIs, MSME credit

- Decided by the Monetary Policy Committee (MPC)

Current Repo Rate in 2025

As of September 2025, the RBI repo rate is 6.50%, while the reverse repo rate is 6.25%.

- Floating home loan EMIs are higher compared to 2023–24

- Fixed deposit rates are more attractive

👉 Official updates: RBI Repo Rate – RBI Website

How Does RBI Decide Repo Rate?

- Inflation – High inflation → repo hike → reduces demand

- Economic Growth – Slow growth → repo cut → boosts borrowing

- Liquidity – Ensures banking system has balanced cash flow

Impact on Different Segments

1. Individuals (Loans & EMIs)

- Repo hike → Home loan EMI on ₹50 lakh (20 years) may rise by ₹2,000–₹3,000/month

- Repo cut → EMIs reduce, refinancing becomes cheaper

- 💡 Tip: Check if your loan is linked to Repo Linked Lending Rate (RLLR)

2. Businesses & MSMEs

- Lower repo → cheaper working capital loans

- Higher repo → rising costs, tighter cash flow

- Example: An MSME borrowing ₹1 crore may save ₹10–15 lakh annually if repo falls by 1%

3. Investors & Savers

- Repo hike → higher FD interest rates

- Higher repo → stock market slows in real estate & auto sectors

- Bonds become more attractive

Why Repo Rate Matters

- Individuals: EMIs, credit card interest

- Businesses: working capital & expansion

- Investors: FD returns, stock market, bonds

- Economy: inflation & growth

How to Benefit from Repo Rate Changes

- Review your loan terms when RBI cuts rates

- Lock-in FDs if rates are rising

- Refinance old loans into repo-linked loans

- Track inflation trends for smarter financial planning

Practical Example – EMI Impact

For a ₹40 lakh home loan (20 years, floating rate):

- At 8% → EMI ≈ ₹33,458

- At 8.5% → EMI ≈ ₹34,459

- At 7.5% → EMI ≈ ₹32,214

📌 Difference: ₹2,200–₹2,300 per month, purely due to repo rate changes.

Conclusion

The RBI repo rate is like a steering wheel of India’s economy. It shapes loan affordability, savings returns, and investment trends. By following repo rate changes, you can make smarter decisions in borrowing, investing, and financial planning.

👉 Stay updated via the RBI Official Repo Rate Page.

FAQs

Q1. What is the difference between repo rate and reverse repo rate?

Repo = RBI lends to banks; Reverse Repo = banks park funds with RBI.

Q2. How often does RBI change the repo rate?

Every two months via the MPC.

Q3. Does repo rate affect home loan EMIs?

Yes, most floating loans are repo-linked.

Q4. What is the current repo rate (2025)?

As of Sept 2025 → 6.50%.