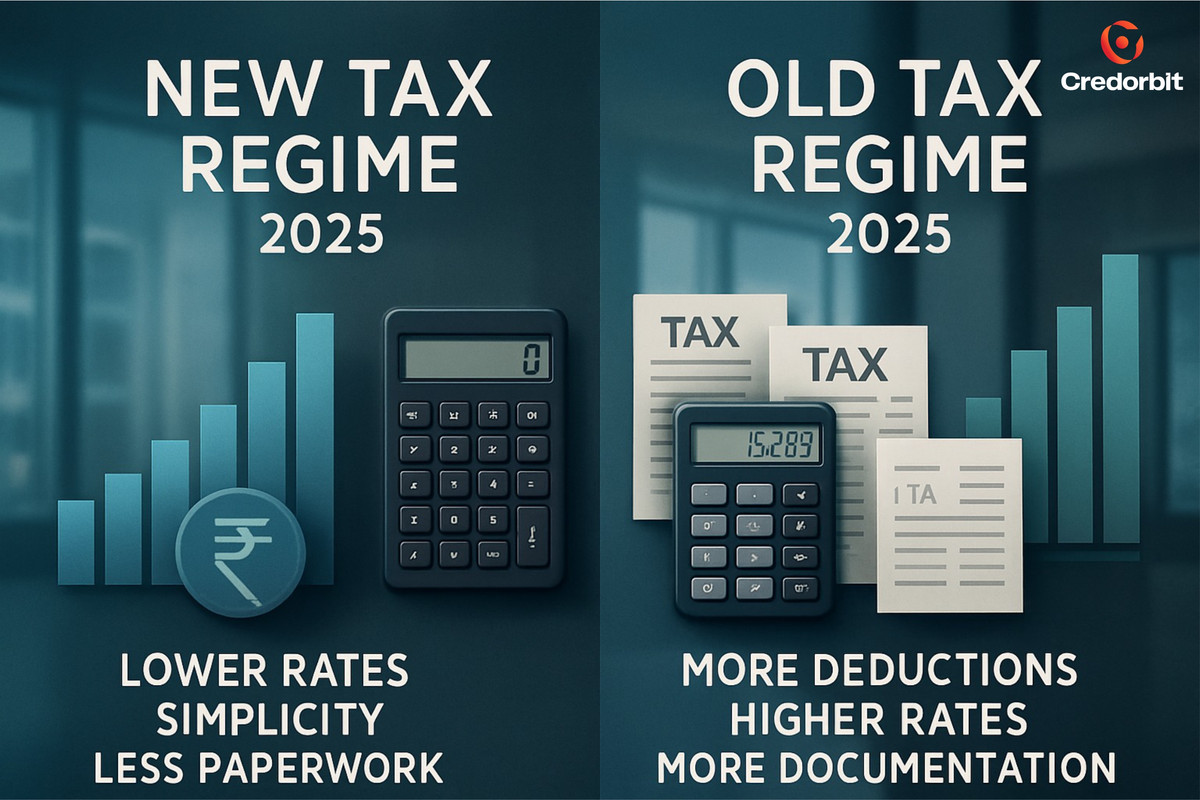

New vs Old Tax Regime for MSMEs in 2025

Tax decisions are no longer just about saving money — they directly impact cash flow, compliance workload, and growth strategy. For MSMEs in 2025, choosing between the New Tax Regime and Old Tax Regime can mean the difference between higher savings or simpler compliance.

At Credorbit, we work with MSMEs every day on financing and compliance strategies. Here’s a practical comparison to help you decide.

1. Overview of the New Tax Regime (2025)

- Lower slab rates for businesses

- Fewer exemptions and deductions

- Reduced paperwork & compliance burden

- Best for MSMEs with straightforward income

Example: An IT consultancy earning ₹50 lakh with no major tax-saving investments may save under this regime.

👉 Official reference: Income Tax India – New Regime Details

2. Overview of the Old Tax Regime (2025)

- Section 80C – PPF, ELSS, LIC premiums

- Section 80D – Health Insurance deductions

- HRA & LTA – House Rent and Travel Allowance

- Depreciation and business expenses as deductions

Example: A manufacturing MSME with employee benefits and insurance can maximize deductions under the old regime.

3. Key Differences – At a Glance

| Criteria | New Regime 2025 | Old Regime 2025 |

|---|---|---|

| Tax Slab Rates | Lower | Higher |

| Deductions/Exemptions | Limited | Wide range available |

| Compliance | Simpler, less paperwork | More documentation required |

| Best For | MSMEs with fewer deductions | MSMEs with multiple investments |

4. Which Regime Should MSMEs Choose?

Choose New Regime if:

- You prefer simplicity and lower rates

- Your business doesn’t claim many deductions

- You want to reduce compliance burden

Choose Old Regime if:

- You invest in multiple tax-saving instruments

- You claim deductions like 80C, 80D, HRA, LTA

- Your taxable income reduces significantly after deductions

5. Expert Tips for MSMEs

- Run both calculations before filing taxes

- Consult a CA or tax advisor for missed deductions

- Recheck annually if income fluctuates

- Balance growth vs savings — sometimes simpler filing is better than chasing deductions

Practical Example – MSME Tax Comparison

Let’s say your MSME has a taxable income of ₹75 lakh:

- Under New Regime → Tax payable = ₹18 lakh (simpler compliance, lower rate)

- Under Old Regime → Tax payable = ₹16.5 lakh (after claiming 80C, 80D, depreciation, and HRA)

👉 Verdict: If you can claim large deductions, the Old Regime saves more. Otherwise, the New Regime is stress-free.

Conclusion

- New Tax Regime 2025: Perfect for MSMEs that want simplicity and lower slab rates.

- Old Tax Regime 2025: Best for businesses that invest in tax-saving avenues and want to maximize exemptions.

The right choice depends on your business model, income structure, and long-term growth goals. At Credorbit, we help MSMEs with Project Finance solutions and are also building Virtual CFO tools (coming soon) to make tax planning easier than ever.

FAQs

- Q1. Can MSMEs switch between new and old tax regimes every year? – Yes, businesses can opt for either regime each year before filing their return.

- Q2. Which regime benefits startups more? – Startups with fewer investments usually benefit from the New Regime due to lower rates and simplicity.

- Q3. Does the new regime allow Section 80C and 80D deductions? – No, most deductions like 80C (PPF, ELSS) and 80D (Health Insurance) are not available.

- Q4. Is the old regime more complex? – Yes, since it offers many deductions, MSMEs must maintain proper documentation.